UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☑ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

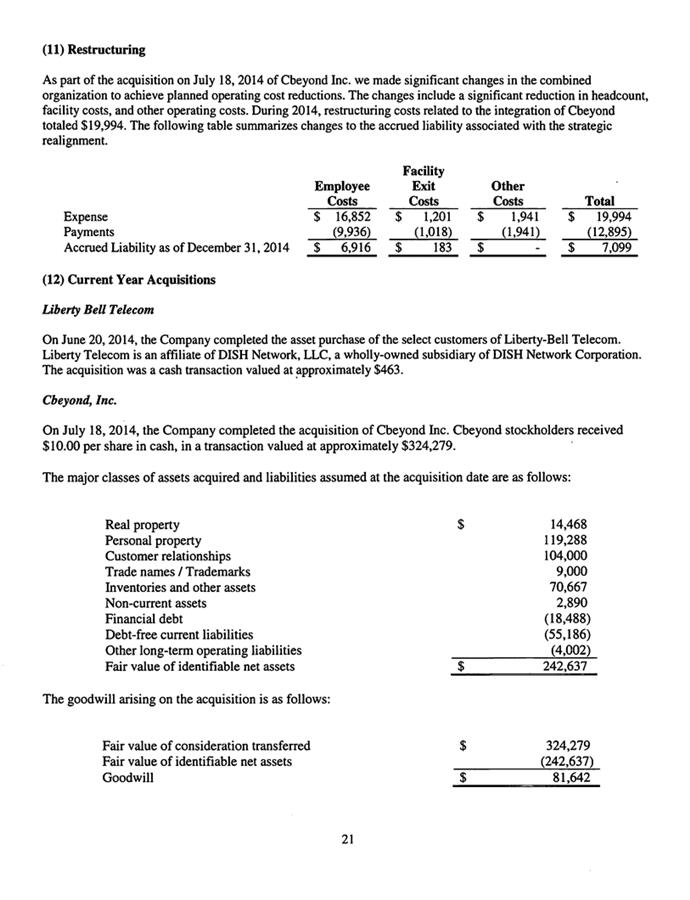

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FUSION TELECOMMUNICATIONS INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. |

| ☑ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: Fusion Common Stock, par value $0.01 per share |

| | 2) | Aggregate number of securities to which transaction applies: In connection with the Merger, Fusion will issue to the seller’s a number of shares equal to 3 times (i) the number of shares of Fusion Common Stock outstanding as of the closing of the Merger, plus (ii) the number of shares of Common Stock issuable upon conversion of all shares of Fusion preferred stock, plus (iii) the number of shares of Fusion Common Stock issuable upon the exercise of all in-the-money warrants (as adjusted for stock splits and calculated using the treasury stock method). As of the date of this filing, that number of shares of Fusion Common Stock equals 74,199,771. |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): The maximum aggregate value was determined based on 74,199,771 shares of Fusion Common Stock to be issued to the seller’s at the closing of the Merger multiplied by $2.48 per share. In accordance with Section 14(g) of the Securities Exchange Act of 1934, as amended, the filing fee was determined by multiplying .0001245 by the sum calculated in the preceding sentence. |

| | 4) | Proposed maximum aggregate value of transaction: $184,015,432.08

|

| | 5) | Total fee paid: $22,909.92

|

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| | 3) | Filing Party: |

| | 4) | Date Filed: |

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

Dated December , 2017

420 Lexington Avenue, Suite 1718

New York, New York 10170

(212) 201-2400

MERGER PROPOSED -- YOUR VOTE IS VERY IMPORTANT

Dear Fellow Stockholders:

I am pleased to invite you to attend the annual meeting of stockholders (referred to as the Annual Meeting) of Fusion Telecommunications International, Inc., a Delaware corporation (referred to as Fusion or the Company) to be held at 3:00 p.m., local time, on [●], 2018. The Annual Meeting will be held at the Company's executive office located at 420 Lexington Avenue, Suite 1718, New York, New York, 10170.10170.

On August 26, 2017, Fusion and its wholly-owned subsidiary Fusion BCHI Acquisition LLC (referred to as Merger Sub) entered into an Agreement and Plan of Merger (as subsequently amended thereafter referred to as the Merger Agreement) with Birch Communications Holdings, Inc., a Georgia corporation (referred to as BCHI) pursuant to which, among other things, BCHI will be merged with and into Merger Sub (referred to as the Merger) with Merger Sub continuing as the surviving company and a wholly-owned subsidiary of Fusion. If the Merger is completed, at the effective time of the Merger (referred to as the Effective Time), all of the shares of common stock, par value $0.01 per share, of BCHI issued and outstanding immediately prior to the Effective Time (other than any shares to be cancelled pursuant to the Merger Agreement) will be converted automatically into the right to receive, in the aggregate, a number of fully paid and non-assessable shares of Fusion’s common stock, par value $0.01 per share (referred to as the Fusion Common Stock), equal to three (3) times the number of shares of (i) Fusion Common Stock issued and outstanding immediately prior to the Effective Time plus (ii) the number of shares of Fusion Common Stock issued or issuable upon the conversion of all classes or series of Fusion preferred stock outstanding immediately prior to the Effective Time plus (iii) the number of shares of Fusion Common Stock issuable upon the exercise of all in-the-money warrants of Fusion (as adjusted for stock splits and calculated using the treasury stock method) (referred to, collectively, as the Merger Shares). Upon completion of the Merger, BCHI Holdings LLC, a Georgia limited liability company formed by the current shareholders of BCHI to hold their Merger Shares (referred to as BCHI Holdings), will own approximately 75% of the total number of shares of Fusion Common Stock then outstanding.

From and after the Effective Time, the size of the Board of Directors of Fusion (referred to as the Board) will be fixed at nine directors. Four directors, including at least one director who satisfies the Nasdaq listing standards’ independence requirements, will be nominated by a nominating committee comprised of the Fusion directors serving on the Board on the date of the nomination (referred to as the Fusion Committee), and four directors, including at least one director who satisfies the Nasdaq listing standards’ independence requirements, will be nominated by BCHI Holdings. The ninth director, who must satisfy the Nasdaq listing standards’ independence requirements, will be nominated by BCHI Holdings subject to the reasonable consent of the Fusion Committee. Matthew D. Rosen, Fusion’s current Chief Executive Officer, will serve as the post-Merger Chairman of the Board, and Holcombe T. Green, Jr., a principal stockholder of BCHI, will serve as the post-Merger Vice Chairman of the Board. At the Effective Time, all other members of Fusion’s current Board will resign. Matthew D. Rosen will be the Chief Executive Officer of the post-Merger Fusion, Gordon Hutchins, Jr. will be President and Russell Markman will be the Chief Operating Officer. The other executive officers of post-merger Fusion will be determined prior to the closing of the Merger by mutual agreement of Fusion and BCHI Holdings. As of the date of this proxy statement, no other executive officers have been chosen. Following completion of the Merger, the headquarters of the combined company will be located at 420 Lexington Avenue, New York, New York 10170, Fusion’s current headquarters.

Shares of the Fusion Common Stock are currently listed on The Nasdaq Capital Market® under the symbol "FSNN." Prior to completion of the Merger, Fusion intends to file an initial listing application with Nasdaq relating to the combined company, pursuant to Nasdaq's “change of control” rules. After completion of the Merger, Fusion will be renamed "Fusion Connect, Inc." but will continue to be referred to as Fusion and expects to continue to trade on The Nasdaq Capital Market® under the symbol "FSNN." We believe that this name change better reflects the Company's image, brand and cloud services focus. On [●], 2017, the last trading day before the date of this proxy statement, the closing sale price of the Fusion Common Stock was $[●] per share. You are urged to obtain a current market quotation for the shares of Fusion Common Stock.

The obligations of Fusion and BCHI to complete the Merger are subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement. Copies of the Merger Agreement and each of the amendments to the Merger Agreement dated September 15, 2017, September 29, 2017 and October 27, 2017 are attached as Annex A to the enclosed proxy statement, and you are encouraged to read these documents in their entirety.

At the Annual Meeting, holders of shares of Fusion Common Stock and Fusion’s Series B-2 Senior Cumulative Convertible Preferred Stock, par value $0.01 per share (referred to as the Series B-2 Preferred Stock and, together with the Fusion Common Stock, referred to as the Voting Shares) will be asked to consider and vote on the following matters:

●

a proposal to adopt the Merger Agreement and approve (i) the Merger, (ii) the issuance of the Merger Shares, and (iii) the other transactions contemplated by the Merger Agreement (Proposal No. 1);

●

a proposal to adopt an amendment to Fusion’s certificate of incorporation, a copy of which is attached as Annex B to the enclosed proxy statement to effectuate a reverse stock split of the issued and outstanding shares of Fusion Common Stock at a ratio of up to 5:1 (referred to as the Certificate of Amendment), to the extent determined necessary by the Board to comply with the Nasdaq listing requirements in connection with the post-Merger listing of the Fusion Common Stock on The Nasdaq Capital Market® (Proposal No. 2);

●

a proposal to adopt an amended and restated certificate of incorporation of the Company (referred to as the Restated Charter) to, among other things, (i) increase the number of authorized shares of Fusion Common Stock from 90,000,000 to 150,000,000, a copy of which is attached as Annex C to the enclosed proxy statement, and (ii) change the Company’s name to “Fusion Connect, Inc.” (Proposal No. 3);

●

a proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4);

●

a proposal to approve, on an advisory basis, certain compensation that may be paid to certain of Fusion’s named executive officers as a result of the Merger (Proposal No. 5);

●

a proposal to elect eight (8) directors to hold office until the earliest to occur of (i) the election and qualification of their successors and (ii) their earlier resignation, death, or removal from office (Proposal No. 6);

●

a proposal to ratify the selection of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal No. 7); and

●

such other business as may properly come before the stockholders at the Annual Meeting or any adjournment or postponement thereof.

Certain Fusion stockholders have entered into to a support agreement with BCHI, whereby such stockholders agreed, among other things, to vote their Voting Shares in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares. At the time of execution of the support agreement, these shares represented 9.8% of the votes entitled to be cast at the Annual Meeting. The shareholders of BCHI have approved the Merger by written consent in lieu of a meeting.

The Board believes that the proposed business combination with BCHI will enhance Fusion’s market position, add important customer scale and revenue and significant network and infrastructure assets, as well as generate significant cost synergies and reduce Fusion’s debt leverage ratio.

After careful consideration, the Board has (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares, are fair to, advisable and in the best interests of Fusion and its stockholders, (ii) approved the execution, delivery and performance by Fusion of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares, and (iii) directed that the Merger Agreement be submitted to Fusion’s stockholders for adoption. The Board’s reasons for reaching these determinations are described in more detail in the enclosed proxy statement.

Accordingly, the Board recommends that you vote “FOR” the proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement (Proposal No. 1). The Board also recommends that you vote “FOR” the proposal to adopt the Certificate of Amendment (Proposal No. 2), “FOR” the proposal to adopt the Restated Charter (Proposal No. 3), “FOR” the proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4), and “FOR” each of the other proposals described in this proxy statement.

Your vote is very important regardless of the number of shares that you own. The Merger cannot be completed unless the proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement, as well as the proposal to adopt the Certificate of Amendment and the proposal to adopt the Restated Charter are each approved by the required vote at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please submit your proxy as soon as possible to make sure that your shares are represented at the Annual Meeting. Information about the Annual Meeting, the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares, and the other business to be considered by stockholders at the Annual Meeting, is contained in the enclosed proxy statement. You are urged to read the enclosed proxy statement (including the exhibits thereto) carefully in its entirety.

Sincerely,

/s/ Matthew D. Rosen

Matthew D. Rosen

Chief Executive Officer

Neither the U.S. Securities and Exchange Commission nor any state securities regulatory agency has approved or disapproved of the Merger Agreement or the other transactions described in this proxy statement, passed upon the merits or fairness of the Merger, or passed upon the adequacy or accuracy of the disclosure in the proxy statement. Any representation to the contrary is a criminal offense.

This proxy statement is dated [●], 2017 and is first being mailed to stockholders on or about [●[●], 2017.

420 Lexington Avenue, Suite 1718

New York, New York 10170

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2018

To the Stockholders of Fusion Telecommunications International, Inc.:

The 2017 annual meeting of stockholders (referred to as the Annual Meeting) of Fusion Telecommunications International, Inc., a Delaware corporation (referred to as Fusion or the Company), will be held at 3:00 p.m., local time, on [●], 2018. The Annual Meeting will be held at the Company's executive office located at 420 Lexington Avenue, Suite 1718, New York, New York, 10170, for the following purposes:

1. to consider and vote on a proposal to adopt the Agreement and Plan of Merger, dated as of August 26, 2017, as amended on September 15, 2017, September 29, 2017 and October 27, 2017, and as it may be amended from time to time (collectively referred to as the Merger Agreement), by and among Fusion, Fusion BCHI Acquisition LLC, a Delaware limited liability company and a wholly-owned subsidiary of Fusion (referred to as Merger Sub), and Birch Communications Holdings, Inc., a Georgia corporation (referred to as BCHI), and to approve (i) the Merger of BCHI with and into Merger Sub (referred to as the Merger), with Merger Sub continuing as the surviving company in the Merger and as a wholly-owned subsidiary of Fusion, (ii) the issuance of a number of fully paid and non-assessable shares of Fusion’s common stock, par value $0.01 per share (referred to as the Fusion Common Stock), equal to three (3) times (A) the number of shares of Fusion Common Stock issued and outstanding immediately prior to the effective time of the Merger (referred to as the Effective Time), plus (B) the number of shares of Fusion Common Stock issued or issuable upon the conversion of all shares of all classes or series of Fusion’s preferred stock outstanding immediately prior to the Effective Time, plus (C) the number of shares of Fusion Common Stock issuable upon the exercise of all in-the-money warrants of Fusion (as adjusted for stock splits and calculated using the treasury stock method) (collectively referred to as the Merger Shares), and (iii) the other transactions contemplated by the Merger Agreement (Proposal No. 1);

2. to consider and vote on a proposal to adopt an amendment to Fusion’s certificate of incorporation to effectuate a reverse stock split of the issued and outstanding shares of Fusion Common Stock at a ratio of up to 5:1 (referred to as the Certificate of Amendment), to the extent determined necessary by the Board of Directors of Fusion (referred to as the Board) to comply with the listing requirements of the NASDAQ Stock Market (referred to as Nasdaq) in connection with the post-Merger listing of the Fusion Common Stock on The Nasdaq Capital Market® (Proposal No. 2);

3. to consider and vote on a proposal to adopt an amended and restated certificate of incorporation of the Company (referred to as the Restated Charter) to, among other things, (i) increase the number of authorized shares of Fusion Common Stock from 90,000,000 to 150,000,000 and (ii) change the Company’s name to “Fusion Connect, Inc.” (Proposal No. 3);

4. to consider and vote on a proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4);

5. to consider and vote on a proposal to approve, on an advisory basis, certaincertain compensation that may be paid to certain of Fusion’s named executive officers as a result of the Merger (Proposal No. 5);

6. to elect eight (8) directors to hold office until the earliest to occur of (i) the election and qualification of their successors and (ii) their earlier resignation, death, or removal from office (Proposal No. 6);

7. to ratify the selection of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal No. 7); and

8. to transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Proposals No. 1, 2 and 3 require the affirmative "FOR" vote by holders of a majority of the Voting Shares issued and outstanding as of the Record Date and entitled to vote thereon, voting as a single class, Proposals No. 4, 5 and 7 require the affirmative "FOR" vote of a majority of the votes cast at the Annual Meeting by the holders of the Voting Shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting as a single class. With respect to Proposal No. 6, directors shall be elected by a plurality of the votes cast at the Annual Meeting by the holders of the Voting Shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting as a single class.

The Board has fixed [●], 2017 as the record date (referred to as the Record Date) for determining stockholders entitled to vote at the Annual Meeting or any adjournment or postponement thereof. Only holders of record of shares of Fusion Common Stock and Fusion’s Series B-2 Senior Cumulative Convertible Preferred Stock, par value $0.01 per share (referred to as the Series B-2 Preferred Stock and, together with the Fusion Common Stock, referred to as the Voting Shares), at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. A complete list of holders of Voting Shares entitled to vote at the Annual Meeting will be available for examination by any Fusion stockholder at the Company's executive office located at 420 Lexington Avenue, Suite 1718, New York, New York, 10170, for purposes pertaining to the Annual Meeting, during normal business hours, for a period of ten days before the Annual Meeting and at the time and place of the Annual Meeting.

The Board recommends that you vote “FOR” the proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement (Proposal No. 1), “FOR” the proposal to adopt the Certificate of Amendment (Proposal No. 2), “FOR” the proposal to adopt the Restated Charter (Proposal No. 3), “FOR” the proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4), “FOR” the proposal to approve, on an advisory basis, certain compensation that may be paid to certain Fusion named executive officers as a result of the Merger (Proposal No. 5), “FOR” the election of each of the eight director nominees (Proposal No. 6), and “FOR” the proposal to ratify the selection of EisnerAmper LLP as Fusion’s independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal No. 7).

Your vote is very important, regardless of the number of shares you own. The Merger cannot be completed unless the proposal to adopt the Merger Agreement as well as the proposal to adopt the Certificate of Amendment and the proposal to adopt the Restated Charter are each approved by the required vote at the Annual Meeting. Whether or not you expect to attend the Annual Meeting, Fusion urges you to vote your shares online, by phone or by mail by completing and returning the accompanying proxy card as promptly as possible to ensure your shares are voted at the Annual Meeting. If you choose to attend the Annual Meeting, you may then vote in person if you so desire, even though you may have executed and returned the proxy. Any stockholder who executes such a proxy may revoke it at any time before it is exercised. A proxy may be revoked at any time before it is exercised by (1) delivering written notice of revocation to Fusion, attention: Philip D. Turits, Corporate Secretary, (2) delivering a duly executed proxy bearing a later date, or (3) attending the Annual Meeting and voting in person.

Information about the Annual Meeting, the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of Merger Shares, and the other business to be considered by Fusion stockholders at the Annual Meeting is contained in the enclosed proxy statement. You are urged to read the enclosed proxy statement (including the exhibits thereto) carefully in its entirety. If you have any questions concerning the Merger or the other matters to be considered at the Annual Meeting, would like additional copies of the proxy statement or need help voting your shares, please contact the Company’s Corporate Secretary, Philip D. Turits, at 212-201-2407 or via email at pturits@fusionconnect.com.

By Order of the Board of Directors,

/s/ PHILIP D. TURITS

Philip D. Turits, Secretary and Treasurer

New York, New York

[●], 2017

ADDITIONAL INFORMATION

The proxy statement incorporates by reference important business and financial information about Fusion from other documents that are not included in or delivered with this proxy statement. The proxy statement, the Company’s Annual Report on Form 10-K and 10-K/A for the year ended December 31, 2016, the Company’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017 and September 30, 2017 and the means to vote by Internet are available at www.proxyvote.com.www.proxyvote.com. This information is available to you without charge upon your written or oral request. You can also obtain the documents incorporated by reference into this proxy statement through the Securities and Exchange Commission (referred to as the SEC) website at www.sec.gov or by requesting them in writing or by telephone at the following addresses and telephone numbers:

By Mail:

Fusion Telecommunications International, Inc.

420 Lexington Avenue, Suite 1718

New York, New York, 10170

Attention: Corporate Secretary

By Telephone:

(212) 201-2407

To receive timely delivery of the documents in advance of the Annual Meeting, you should make your request no later than [●], 2018.

SUBMITTING PROXIES ELECTRONICALLY OR BY TELEPHONE

Fusion stockholders of record as of the close of business on [●], 2017, the record date for the Annual Meeting (referred to as the Record Date), may submit their proxies by telephone or Internet by following the instructions on their proxy card or voting instruction form. If you have any questions regarding whether you are eligible to submit your proxy by telephone or by Internet, please contact Philip D. Turits, Corporate Secretary, by telephone at (212) 201-2407 or via email at pturits@fusionconnect.com.

PROXY STATEMENT FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| | Page No.

|

| Additional Information | i |

| Submitting Proxies Electronically or by Telephone | i |

| Questions and Answers About the Annual Meeting and the Merger | 1 |

| Summary | 12 |

| Parties to the Merger Agreement | 12 |

| The Merger Agreement and the Merger | 13 |

| The Annual Meeting | 21 |

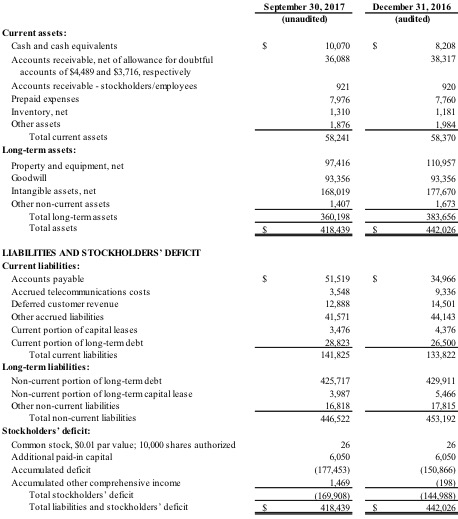

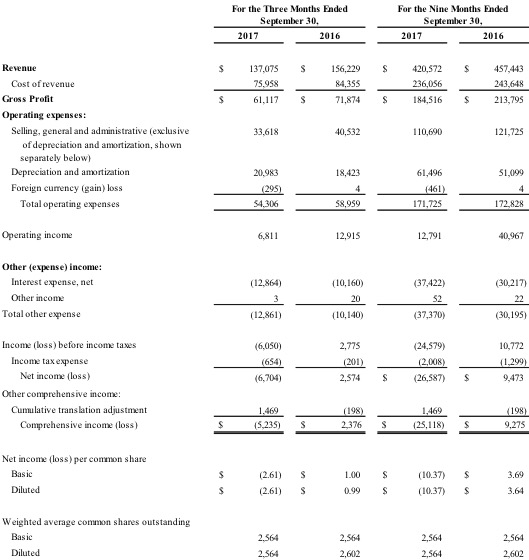

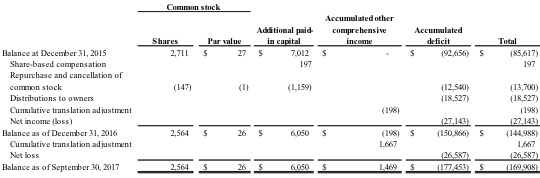

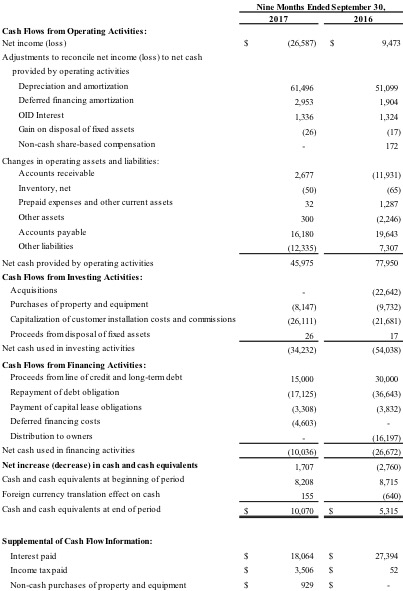

| Summary Selected Historical Financial Data | 25 |

| Summary Unaudited Pro Forma Condensed Combined Consolidated Financial Information | 30 |

| Market Price and Dividend Information | 35 |

| Forward Looking Statements | 37 |

| The Annual Meeting | 38 |

| Date, Time and Place of the Annual Meeting | 38 |

| Purpose of the Annual Meeting | 38 |

| Recommendation of the Board | 38 |

| Record Date | 39 |

| Quorum and Required Vote | 39 |

| Treatment of Abstentions, Non-Voting and Incomplete Proxies | 39 |

| Voting | 40 |

| Revocation of Proxies | 41 |

| Postponement and Adjournment | 41 |

| Voting by Fusion Directors and Executive Officers | 42 |

| Appraisal Rights | 42 |

| Solicitation of Proxies | 42 |

| Other Business | 42 |

| Householdings | 42 |

| Additional Assistance | 43 |

| The Merger | 43 |

Rationale for the Merger

| 43 |

| Background of the Merger | 43 |

| Reasons for the Merger and Recommendation of the Board | 48 |

| Opinion of FTI Capital Advisors, LLC | 51 |

| Management Projections | 57 |

| Financing of the Merger | 59 |

| Accounting for the Merger | 59 |

| Effects on Fusion if the Merger is Not Consummated | 60 |

| Interests of Fusion’s Officers and Directors in the Merger | 60 |

| Regulatory Matters | 63 |

| Material U.S. Federal Income Tax Consequences | 64 |

| Nasdaq Listing | 65 |

| The Merger Agreement | 65 |

Structure of the Merger

| 65

|

| Effective Time; Marketing Period | 66 |

| Consideration to be Received in the Merger | 66 |

| Exchange and Payment Procedures | 67 |

| Directors/Members and Officers of the Surviving Company and Other Subsidiaries | 67 |

| Board of Directors of Post-Merger Fusion | 67 |

| Executive Officers of Fusion Following the Merger | 67 |

| Representations and Warranties | 68 |

| Covenants Relating to the Conduct of the Business of the Parties | 69 |

| Efforts to Complete the Merger; Filings; Other Actions | 71 |

| Preparation of the Proxy Statement | 72 |

| Stockholders’ Meeting | 72 |

| No Solicitation of Transactions | 72 |

| Access to Information | 74 |

| Employee Matters | 74 |

| Indemnification of Officers and Directors | 75 |

| Nasdaq Listing; Reverse Split | 75 |

| Financing | 75 |

| Certain Additional Covenants | 76 |

| Conditions to the Merger | 76 |

| Termination and No Termination Fees | 78 |

| Fees and Expenses | 79 |

| Amendment and Supplement | 79 |

| Governing Law; Jurisdiction | 79 |

| Specific Performance | 79 |

| Amendments to the Merger Agreement | 79 |

| Agreements Related to the Merger Agreement | 80 |

| Stockholders’ Agreement | 80 |

| Registration Rights Agreement | 80 |

| Support Agreement | 81 |

| Indemnity Agreement | 81 |

| Consumer Spin-Off and Carrier Spin-Off | 82 |

| Consumer Spin-Off | 82

|

| Carrier Spin-Off | 83 |

| Proposal No. 1 – Adoption of the Merger Agreement | 84 |

| Effects on Other Proposals | 84 |

| Required Vote and Board Recommendation | 84 |

| Proposal No. 2 – Approval of an Amendment to the Certificate of Incorporation of Fusion to Effect a Reverse Stock Split | 85 |

| Background and Reasons for the Proposal | 85 |

| The Board’s Discretion to Effect the Reverse Stock Split | 86 |

| Effects of the Reverse Stock Split on Fusion Common Stock | 86 |

| Manner of Effecting the Reverse Split Proposal | 87 |

| Fractional Shares | 88 |

| Potential Anti-Takeover Effect | 88 |

| No Appraisal Rights | 88 |

| Certain Federal Income Tax Consequences | 88 |

| Effect on Other Proposals | 88 |

| Required Vote and Board Recommendation | 89 |

| Proposal No. 3 – Amended and Restated Certificate of Incorporation | 90 |

| Background of and Reasons for the Proposal | 90 |

| Name Change | 90 |

| Increase in Authorized Shares of Fusion Common Stock | 90 |

| Other Amendments Contemplated by the Restated Charter | 92 |

| No Dissenter’s Rights | 92 |

| Effect on Other Proposals | 92 |

| Required Vote and Board Recommendation | 92 |

| Proposal No. 4 – Adjournment of the Annual Meeting | 93 |

| Required Vote and Board Recommendation | 93 |

| Proposal No. 5 – Advisory Vote on Merger-Related Compensation of Fusion’s Named Executive Officers | 94 |

| Background and Reasons for the Proposal | 94 |

| Effects on Other Proposals | 94 |

| Required Vote and Board Recommendation | 94 |

| Executive Officers of Fusion | 95 |

| Executive Compensation | 97 |

| Fiscal 2016 Summary Compensation Table | 97 |

| Employment Agreements, Termination of Employment and Change-In-Control Arrangements | 98 |

| Determination of Executive Compensation | 98 |

| 2016 Equity Incentive Plan | 99 |

| 2009 and 1998 Stock Option Plans | 100 |

| Outstanding Equity Awards at 2016 Year-End | 100 |

Equity Compensation Plan Information

| 102 |

| Proposal No. 6 – Election of Directors | 103 |

| Nominees for Election of Directors | 103 |

| Director Background and Qualifications | 103 |

| Required Vote and Board Recommendation | 105 |

| Corporate Governance | 106 |

| Board of Directors | 106 |

| Board Meetings and Attendance | 106 |

| Annual Meeting Attendance | 106 |

| Stockholder Communications with Directors | 106 |

| Code of Ethics | 106 |

| Board Committees | 107 |

| Compensation Committee | 107 |

| Stockholder Nomination of Directors | 108 |

| Director Qualifications | 108 |

| Strategic and Investment Banking Committee | 108 |

| Board Role in Risk Oversight | 108 |

| Certain Relationships, Related Transactions and Director Independence | 109 |

| Officer and Director Loans to Company | 109 |

| Director Independence | 109 |

| 2016 Director Compensation | 109 |

| Engagement for Tax Services | 110 |

| Proposal No. 7 – To Ratify the Selection of EisnerAmper LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2017 | 111 |

| Reason for the Proposal | 111 |

| Audit and Audit-Related Fees | 111 |

| Tax Related Fees | 111 |

| All Other Fees | 111 |

| Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Accountants | 111 |

| Required Vote and Recommendation | 112 |

| Audit Matters | 113 |

| Audit Committee | 113 |

| Audit Committee Report | 114 |

| Voting Securities and Principal Holders Thereof | 115 |

| Principal Stockholders | 115 |

| Other Matters | 117 |

| Section 16(A) Beneficial Ownership Reporting Compliance | 117 |

| Stockholder Proposals for the 2018 Annual Meeting | 117 |

| Where You Can Find More Information | 117 |

| Birch Communications Holdings, Inc. Description of Business | 119 |

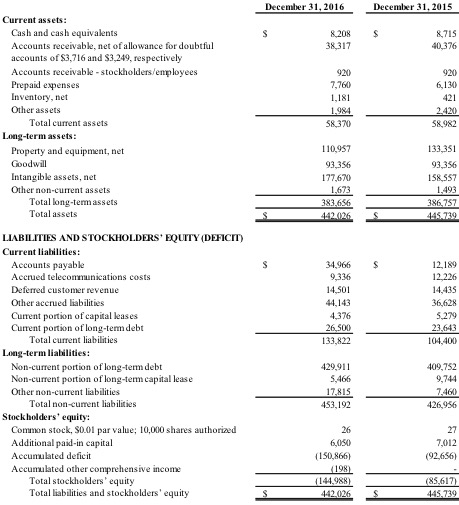

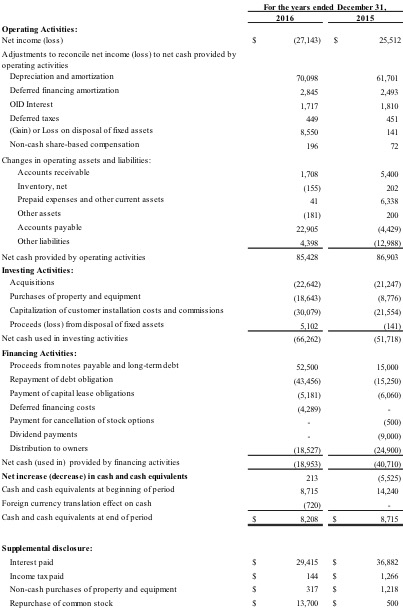

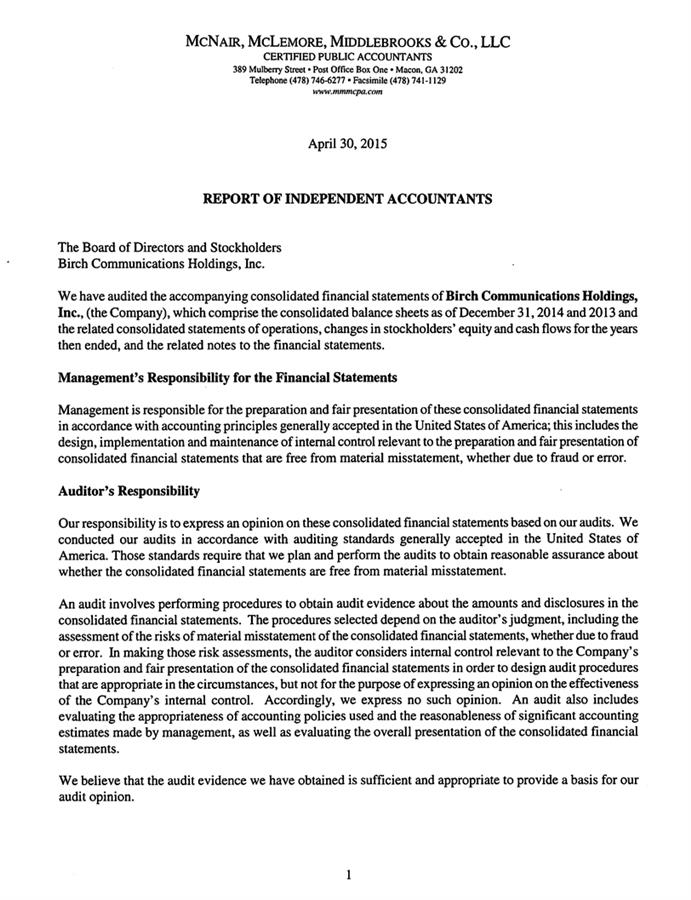

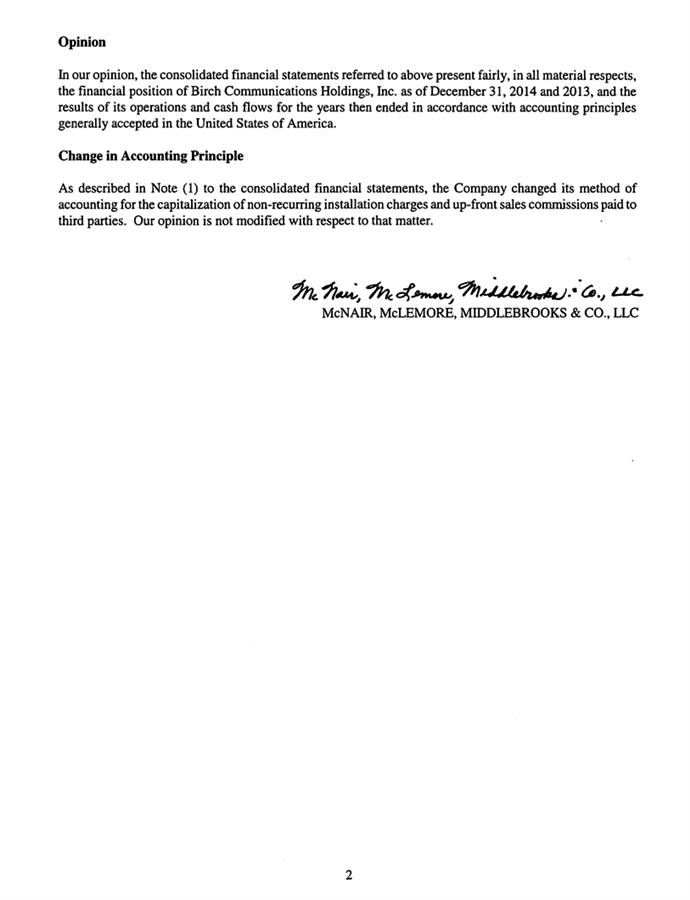

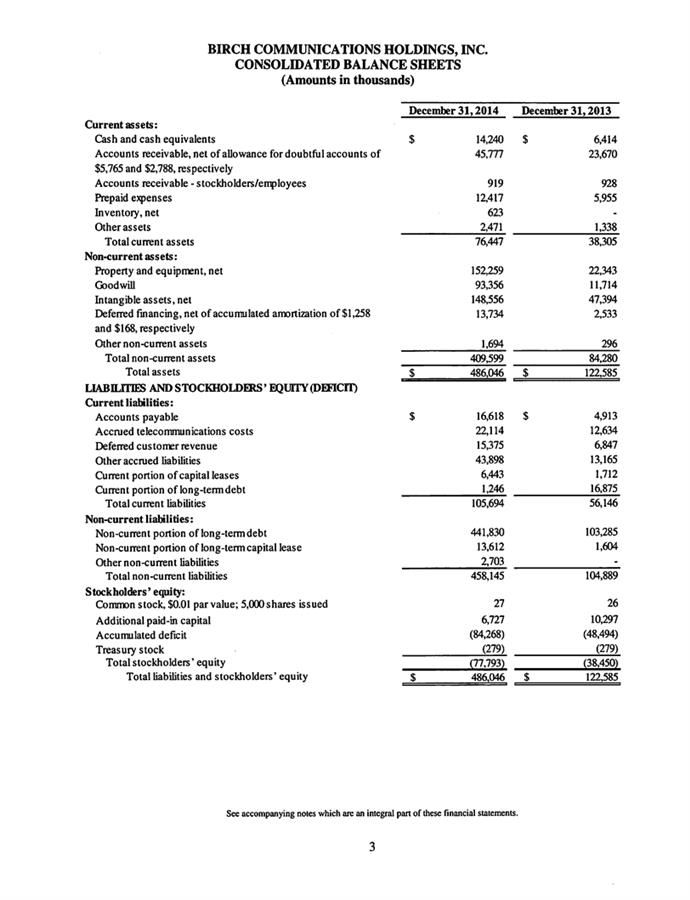

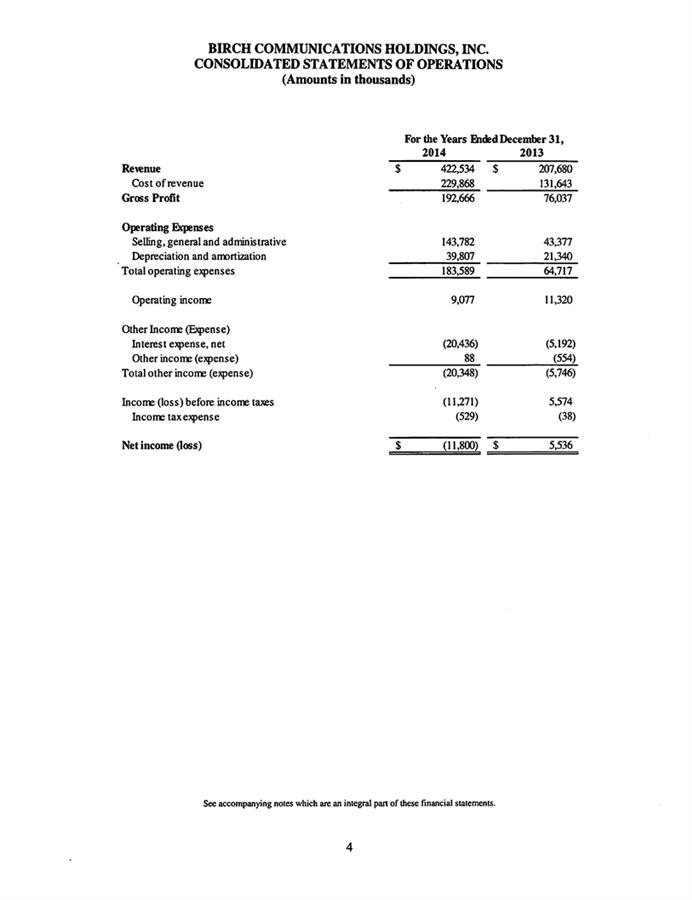

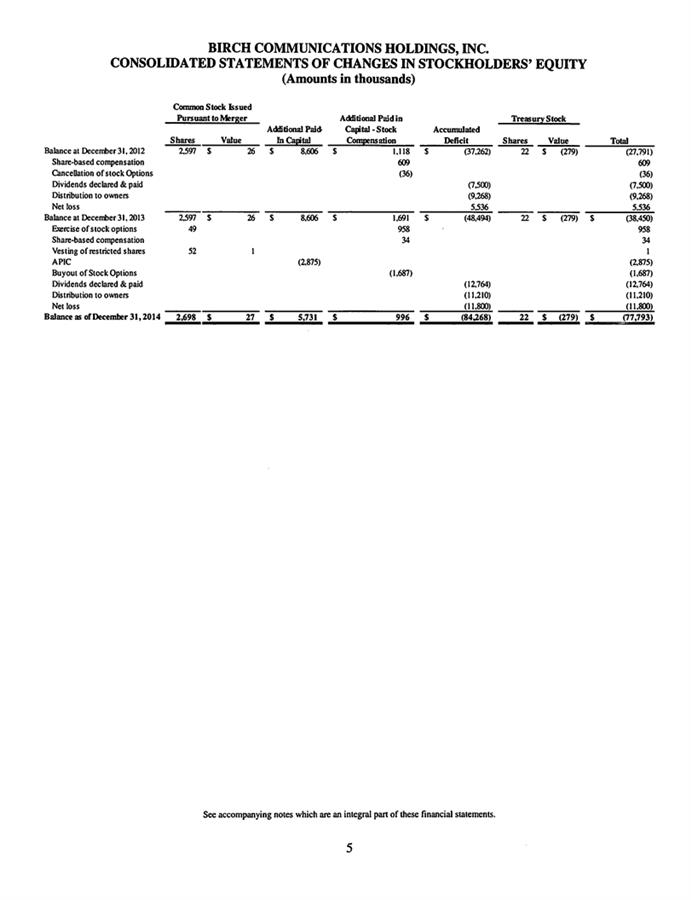

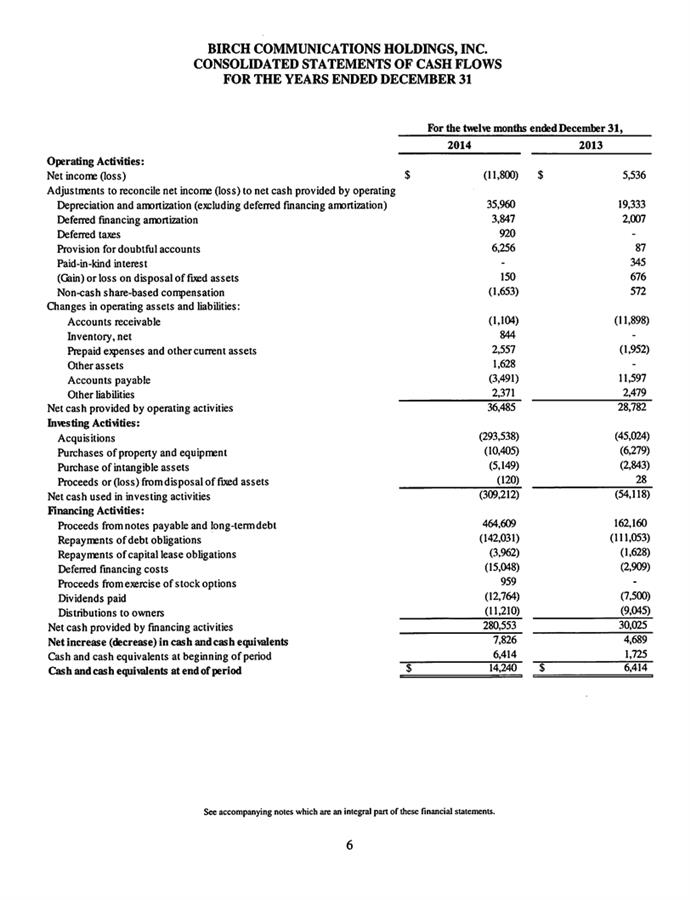

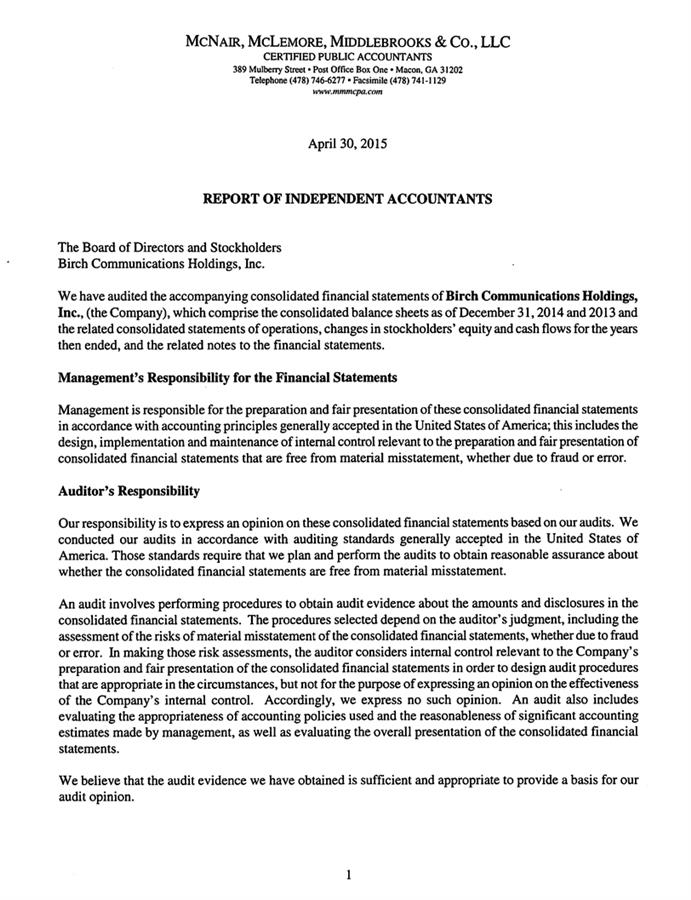

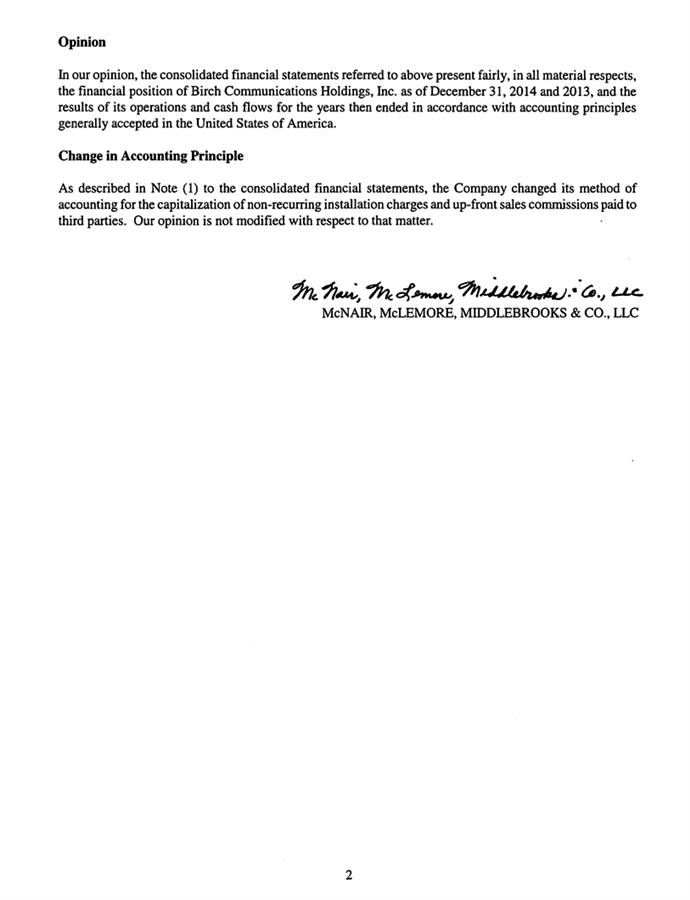

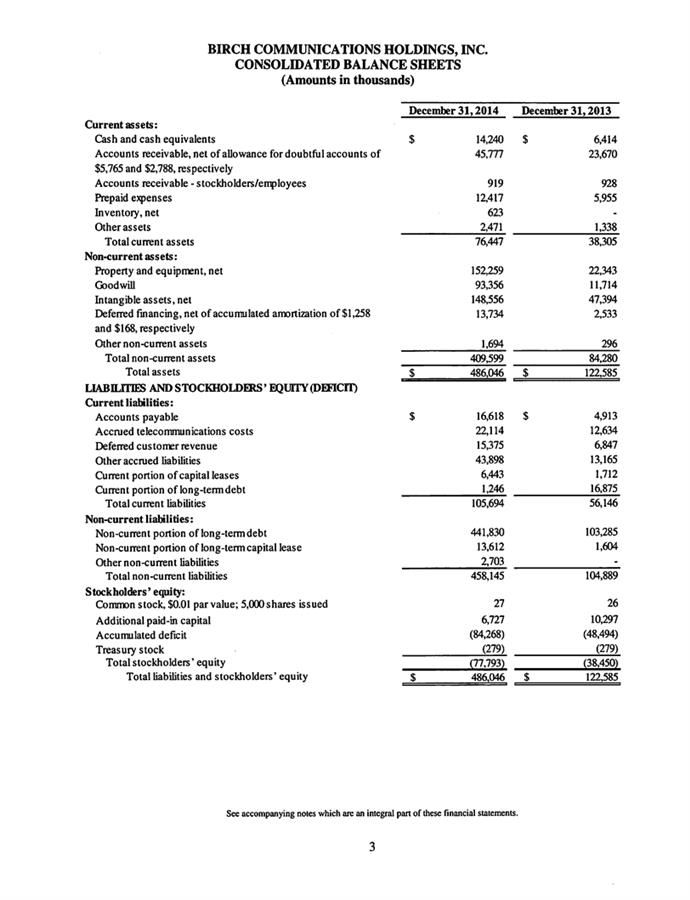

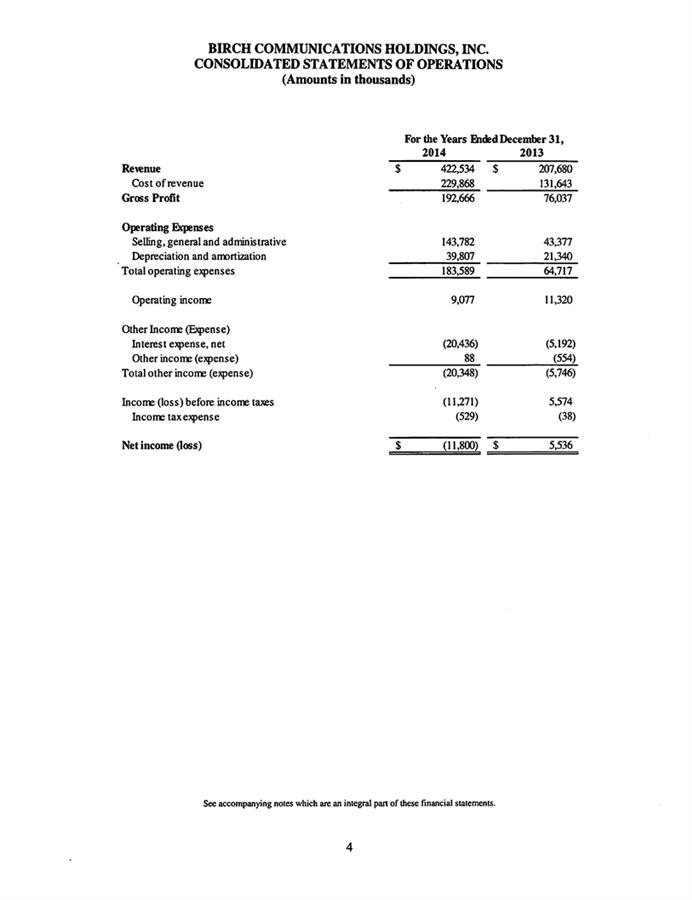

| Birch Communications Holdings, Inc. Financial Statements | F-1 |

| Birch Communications Holdings, Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations | F-46 |

| Annex A – Merger Agreement, Merger Agreement Amendments and Ancillary Agreements | A-1 |

| Annex B –Form of Certificate of Amendment | B-1 |

Annex C –Form–Form of Restated Charter

| |

| Annex D – Opinion of FTI Capital Advisors, LLC | D-1 |

PROXY STATEMENT FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THE MERGER

In this proxy statement, unless the context otherwise requires, the term “Fusion,” the “Company,” “we,” “us,” and “our” refer to Fusion Telecommunications International, Inc., a Delaware corporation. The term “BCHI” refers to Birch Communications Holdings, Inc., a Georgia corporation, and the term “Merger Sub” refers to Fusion BCHI Acquisition LLC, a Delaware limited liability company and wholly-owned subsidiary of Fusion. The term “Surviving Company” refers to Merger Sub following consummation of the proposed Merger. The term “Merger Agreement” refers to the Agreement and Plan of Merger, dated as of August 26, 2017, as amended on September 15, 2017, September 29, 2017 and October 27, 2017 and as it may be further amended from time to time, by and among Fusion, BCHI and Merger Sub. The term Board means the Board of Directors of Fusion from time to time constituted. The terms “you” and the “Fusion Stockholders” refer to holders of shares of Fusion’s common stock, par value $0.01 per share (the “Fusion Common Stock”) and holders of Fusion’s Series B-2 Senior Cumulative Convertible Preferred Stock, par value $0.01 per share (the “Series B-2 Preferred Stock” and, together with the Fusion Common Stock, referred to as the “Voting Shares”).

The following questions and answers briefly address some commonly asked questions about the 2017 Annual Meeting of Fusion Stockholders (referred to as the Annual Meeting), the Merger Agreement, the Merger and the other matters to be considered at the Annual Meeting. These questions and answers do not contain all of the details that may be important to you as a Fusion Stockholder. Therefore, we encourage you to carefully read this entire proxy statement, its annexes and the documents referred to or incorporated by reference in, this proxy statement. You may obtain the information incorporated by reference in this proxy statement, without charge, from Fusion by following the instructions under “Where You Can Find More Information” on page 117 hereof.

Except where specifically noted, the following information and all other information contained in this proxy statement does not give effect to the reduction of the number of issued and outstanding shares of Fusion Common Stock as a result of the proposed reverse stock split, as described in “Proposal No. 2 -- Approval of An Amendment to the Certificate of Incorporation of Fusion to Effect a Reverse Stock Split,” beginning on page 85 in this proxy statement.

| Q: | What is the Merger? |

| A: | Fusion, BCHI and Merger Sub have entered into the Merger Agreement. A copy of the Merger Agreement is attached hereto as Annex A. The Merger Agreement contains the terms and conditions of the proposed business combination between Fusion and BCHI. Under the Merger Agreement, subject to satisfaction (or waiver, to the extent permissible under the Merger Agreement and applicable law) of the conditions set forth in the Merger Agreement and described in this proxy statement, BCHI will be merged with and into Merger Sub (referred to as the Merger), with Merger Sub continuing as the surviving company in the Merger and a wholly-owned subsidiary of Fusion. |

| Q: | What are the Merger Shares? |

| A: | If the Merger is completed, at the effective time of the Merger (referred to as the Effective Time), all of the shares of common stock, par value $0.01 per share, of BCHI issued and outstanding immediately prior to the Effective Time (other than any shares to be cancelled pursuant to the Merger Agreement) will be converted automatically into the right to receive, in the aggregate, a number of fully paid and non-assessable shares of Fusion Common Stock equal to three (3) times (i) the number of shares of Fusion Common Stock issued and outstanding immediately prior to the Effective Time, plus (ii) the number of shares of Fusion Common Stock issued or issuable upon the conversion of all shares of all classes or series of Fusion’s preferred stock outstanding immediately prior to the Effective Time, plus (iii) the number of shares of Fusion Common Stock issuable upon the exercise of all in-the-money warrants of Fusion (as adjusted for stock splits and calculated using the treasury stock method) (collectively, referred to as the Merger Shares). Upon completion of the Merger, BCHI Holdings LLC, a Georgia limited liability company formed by the current shareholders of BCHI to hold their Merger Shares (referred to as BCHI Holdings), will own approximately 75% of the total number of shares of Fusion Common Stock then outstanding. |

| Q: | Why am I receiving these materials? |

| A: | The Company is delivering these proxy materials to you in connection with its solicitation of proxies for use at the Annual Meeting. At the Annual Meeting, Fusion’s Stockholders will be asked to approve, among other things, proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement. The Merger cannot occur without the required approval by the Fusion Stockholders of each of Proposal Nos. 1, 2 and 3. |

| Q: | Why is Fusion seeking Fusion Stockholder approval for the Merger and the issuance of the Merger Shares? |

| A: | The Merger Agreement requires that Fusion obtain approval of its stockholders for the Merger and the other transactions contemplated by the Merger Agreement. In addition, the Fusion Common Stock is listed on TheThe Nasdaq Capital Market®, and Fusion is subject to the listing rules of the NASDAQ Stock Market (referred to as Nasdaq), as follows: ● Nasdaq Rule 5635(b) requires stockholder approval of any issuance or potential issuance of securities when the issuance will result in a “change of control” of the issuer. Nasdaq has previously indicated that the acquisition of, or right to acquire, by a single investor or affiliated investor group, as little as 20% of the common stock (or securities convertible into or exercisable for common stock) or voting power of an issuer could constitute a change of control. ● Stockholder approval is also required under Nasdaq Rule 5635(a) prior to the issuance of securities in connection with the acquisition of the stock or assets of another company if, among other things, the number of shares of common stock to be issued is or will be equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the stock or securities. ● In addition, Nasdaq Rule 5635(d) requires stockholder approval if a listed company issues common stock (or securities convertible into or exercisable for common stock) in a private placement equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock. The number of Merger Shares to be issued to BCHI Holdings will exceed 20% of the shares of Fusion Common Stock issued and outstanding immediately prior to the Effective Time. Moreover, as described above, the proposed issuance of the Merger Shares will result in a change in control of Fusion within the meaning of Nasdaq Rule 5635(b). Accordingly, approval of the issuance of the Merger Shares in the Merger by Fusion Stockholders is required under the Nasdaq listing rules. |

| Q: | When and where is the Annual Meeting? |

| A: | The Annual Meeting will take place at 3:00 p.m., local time, on [●], 2018 at the Company’s executive office located at 420 Lexington Avenue, Suite 1718, New York, New York. |

| Q: | Who is entitled to attend the Annual Meeting? |

| | All holders of shares of Fusion Common Stock and Series B-2 Preferred Stock as of the close of business on [●], 2017, the record date for the Annual Meeting (referred to as the Record Date) are entitled to receive notice of, attend the Annual Meeting and any adjournment or postponement thereof, and vote at the Annual Meeting. You are entitled to attend and vote at the Annual Meeting only if you were a Fusion Stockholder as of the Record Date or hold a valid proxy for the Annual Meeting. |

| A: | What is included in the proxy materials? |

| | This proxy statement includes information that we are required to provide you under the rules of the SEC, which information is intended to assist you in determining how to vote your Voting Shares at the Annual Meeting. The proxy materials include: ● this proxy statement, including a copy of the Merger Agreement and the other documents attached as an annex to this proxy statement; ● our Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended December 31, 2016 and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017 and September 30, 2017, which are incorporated by reference in this proxy statement, as described under “Where You Can Find More Information” on page 117 hereof; and ● the proxy card or a voting instruction form for the Annual Meeting. |

| Q: | What items of business will be considered and voted on at the Annual Meeting? |

| A: | At the Annual Meeting, Fusion Stockholders present in person or represented by proxy and entitled to vote thereon will be asked: ● to consider and vote on a proposal to adopt the Merger Agreement and approve (i) the Merger, (ii) the issuance of the Merger Shares, and (iii) the other transactions contemplated by the Merger Agreement (Proposal No. 1); ● to consider and vote on a proposal to adopt an amendment to Fusion’s certificate of incorporation to effectuate a reverse stock split of the issued and outstanding shares of Fusion Common Stock at a ratio of up to 5:1 (referred to as the Certificate of Amendment), to the extent determined necessary by the Board to comply with Nasdaq listing requirements in connection with the post-Merger listing of the Fusion Common Stock on The Nasdaq Capital Market® (Proposal No. 2); ● to consider and vote on a proposal to adopt an amended and restated certificate of incorporation of the Company (referred to as the Restated Charter) to, among other things, (i) increase in the number of authorized shares of Fusion Common Stock from 90,000,000 to 150,000,000 and (ii) change the Company’s name to “Fusion Connect, Inc.” (Proposal No. 3); ● to consider and vote on a proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4); ● to consider and vote on a proposal to approve, on an advisory basis, certain compensation that may be paid to certain of Fusion’s named executive officers as a result of the Merger (Proposal No. 5); ● to elect eight (8) directors nominated by the Board to hold office until the earliest to occur of (i) the election and qualification of their successors, and (ii) their earlier resignation, death, or removal from office (Proposal No. 6); ● to ratify the selection of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal No. 7); and ● to transact such other business as may properly come before the stockholders at the Annual Meeting or any adjournment or postponement thereof. |

| Q: | How can I vote for the various proposals? |

| A: | For each of the proposals to be considered and voted on at the Annual Meeting, except the election of directors (Proposal No. 6), you may vote “FOR,” “AGAINST” or “ABSTAIN.” In the election of directors (Proposal No. 6), you may vote “FOR” all or some of the nominees, or your vote may be “WITHHELD” with respect to one or more of the nominees. |

| Q: | How does the Board recommend that I vote? |

| A: | After careful consideration, the Board has (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares, are fair to, advisable and in the best interests of Fusion and its stockholders, (ii) approved the execution, delivery and performance by Fusion of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares, and (iii) directed that the Merger Agreement be submitted to the Fusion Stockholders for adoption. The Board’s reasons for recommending the Merger are set forth in more detail under the section entitled “The Merger – Reasons for the Merger and Recommendation of the Board” on page 48. Accordingly, the Board recommends that you vote your Voting Shares: ● “FOR” the proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement (Proposal No. 1); ● “FOR” the proposal to adopt the Certificate of Amendment (Proposal No. 2); ● “FOR” the proposal to adopt the Restated Charter (Proposal No. 3); ● “FOR” the proposal to adjourn the Annual Meeting, if necessary, to solicit additional votes in favor of the proposals to adopt the Merger Agreement, to adopt the Certificate of Amendment and to adopt the Restated Charter (Proposal No. 4); and ● “FOR” the proposal to approve, on an advisory basis, certain compensation that may be paid to certain of Fusion’s named executive officers as a result of the Merger (Proposal No. 5). In addition, the Board recommends that you vote your Voting Shares: ● “FOR” the election of the eight directors nominated by the Board (Proposal No. 6); and ● “FOR” the proposal to ratify the selection of EisnerAmper LLP as Fusion’s independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal No. 7). |

| Q: | Who is entitled to vote at the Annual Meeting? |

| | Only holders of shares of Fusion Common Stock and Series B-2 Preferred Stock as of the Record Date are entitled to vote on all matters that come before the Annual Meeting. Voting Shares can be voted only if the Fusion Stockholder is present at the Annual Meeting in person or represented by proxy. As described below, the voting procedures may be different for stockholders of record and beneficial owners. |

| A: | How many votes do I have? |

| | Except as otherwise specified to the contrary in this proxy statement, the holders of shares of Fusion Common Stock and the holders of shares of Series B-2 Preferred Stock will vote as a single class on each matter submitted to a vote of stockholders at the Annual Meeting. Each share of Fusion Common Stock that you own as of the Record Date entitles you to one vote. Each share of Series B-2 Preferred Stock that you own as of the Record Date entitles you to 200 votes, which is the number of Fusion Common Shares into which a share of Series B-2 Preferred Stock may be converted as of the Record Date. As of the Record Date, there were [●] issued and outstanding shares of Fusion Common Stock, which are entitled in the aggregate to [●] votes, and [●] issued and outstanding shares of Series B-2 Preferred Stock, which are entitled in the aggregate to[●] votes. The Voting Shares issued and outstanding as of the Record Date are collectively entitled to a total of [●] votes at the Annual Meeting. |

| Q: | Why is the number of shares shown as owned by me online different from the number of shares in my records? |

| A: | The number of shares of Fusion Common Stock shown on www.proxyvote.com may be different from the number of shares of Fusion Common Stock shown in your records because the number of shares shown in that database, as well as all of the per share information contained in this proxy statement, gives effect to a 50:1 reverse split of the Fusion Common Stock that occurred in May 2014. |

| Q: | What is the difference between holding Voting Shares as a stockholder of record and as a beneficial owner? |

| A: | If your Voting Shares are registered directly in your name with Fusion’s transfer agent, Continental Stock Transfer & Trust Company, you are considered, with respect to those shares, the “stockholder of record” and the proxy materials have been made available to you directly by Fusion. If your Voting Shares are held in a brokerage account or by a broker, bank or other nominee (referred to as an Organization), you are considered the “beneficial owner” of those Voting Shares held in “street name” and the proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your Voting Shares by following the voting instructions on the form that you receive from your broker, bank or other nominee. You may not vote your Voting Shares by returning a proxy card directly to the Company or by voting in person at the Annual Meeting unless you obtain a “legal proxy” from the Organization that holds your Voting Shares giving you the right to vote those shares. |

| Q: | If my Voting Shares are held by an Organization in “street name,” will my Organization vote my Voting Shares for me? |

| A: | If your Voting Shares are held by an Organization in “street name,” you must provide your broker, bank or other nominee with instructions on how to vote your shares. Please follow the instructions provided by your broker, bank or other nominee regarding the voting of your Voting Shares. Banks, brokers and other nominees that hold shares in “street name” for a beneficial owner typically have the authority to vote in their discretion only on “routine” matters and are not allowed to exercise their discretion on matters that are determined to be “non-routine” without specific instructions from the beneficial owner. If your Voting Shares are held by an Organization in “street name” and you do not provide your Organization with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes are shares held by a bank, broker or other nominee that are represented at the Annual Meeting, but with respect to which the bank, broker or other nominee has not received instructions from the beneficial owner to vote on a particular proposal and the bank, broker or other nominee does not have discretionary voting power on such proposal. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered votes cast with respect to that proposal. Under current Nasdaq rules, Fusion believes that banks, brokers or other nominees do not have discretionary authority to vote on any proposals to be voted on at the Annual Meeting, other than with respect to Proposal No. 7. Therefore, if you do not instruct your bank, broker or other nominee as to how to vote your Voting Shares, your bank, broker or other nominee will not vote your shares on any of the proposals to be voted on at the Annual Meeting, other than Proposal No. 7, which will have the same effect as a vote “AGAINST” Proposal Nos. 1, 2 and 3, but will have no effect on Proposal Nos. 4, 5, 6 and 7. |

| Q: | How can I vote my Voting Shares in person at the Annual Meeting? |

| A: | You may vote your Voting Shares held in your name as a stockholder of record in person at the Annual Meeting. You may vote your Voting Shares held beneficially in “street name” in person at the Annual Meeting only if you obtain a “legal proxy” from the Organization that holds your Voting Shares giving you the right to vote those shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. |

| Q: | How can I vote my Voting Shares without attending the Annual Meeting? |

| A: | Whether you hold Voting Shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by proxy. You can vote by proxy by telephone, over the Internet or by mail pursuant to instructions provided in the proxy card. If you hold your Voting Shares beneficially in “street name,” you must follow the voting instructions provided to you by the Organization through which you hold your Voting Shares. |

| Q: | What happens to my vote if I sell my Voting Shares before the Annual Meeting? |

| A: | The Record Date for determining stockholders entitled to vote at the Annual Meeting is earlier than the date of the Annual Meeting. If you transfer your Voting Shares after the Record Date but before the Annual Meeting, unless special arrangements (such as provision of a proxy) are made between you and the person to whom you transfer your Voting Shares and each of you notifies Fusion in writing of such special arrangements, you will retain your right to vote such shares at the Annual Meeting but will transfer all other rights of ownership of those shares to the person to whom you transfer your Voting Shares. |

| Q: | Can I change my vote or revoke my proxy? |

| A: | If you are a stockholder of record, you may revoke your vote at any time prior to taking the vote at the Annual Meeting by: ● granting a new proxy bearing a later date by following the instructions provided in the proxy card, which will automatically revoke the previous proxy; ● providing a written notice of revocation to Fusion’s Corporate Secretary, 420 Lexington Avenue, Suite 1718, New York, New York 10170; or ● attending the Annual Meeting and voting in person. If you hold Voting Shares beneficially in street name, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by: ● submitting new voting instructions to the Organization through which you hold your Voting Shares by following the instructions they provided; or ● if you have obtained a legal proxy from the Organization through which you hold your Voting Shares giving you the right to vote your Voting Shares, by attending the Annual Meeting and voting in person using the valid legal proxy. Note that with respect to both stockholders of record and beneficial owners, attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting. |

| Q: | I share an address with another Fusion Stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

| A: | We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, we deliver a single copy of the proxy materials to multiple Fusion Stockholders who share the same address unless we receive contrary instructions from one or more of those Fusion Stockholders. This procedure reduces our printing costs, mailing costs and fees. Fusion Stockholders that participate in householding will continue to be able to access and receive separate proxy cards. Upon written request of a Fusion Stockholder, we will promptly deliver a separate copy of the proxy materials. Fusion Stockholders may request such a change by sending the Company an e-mail at proxymaterial@fusionconnect.comor by contacting Fusion’s Corporate Secretary by mail at 420 Lexington Avenue, Suite 1718, New York, New York 10170 or by phone at 212-201-2407. Fusion Stockholders who hold Voting Shares in street name may contact the Organization through which they hold their Voting Shares to request information about householding. |

| Q: | What is a quorum and how many Voting Shares must be present in person or represented by proxy to conduct business at the Annual Meeting?Meeting? |

| A: | In accordance with Fusion’s by-laws, in order for any matter to be considered at the Annual Meeting, there must be a quorum present. The holders of a majority of the voting power of the outstanding Voting Shares, present in person or represented by proxy at the Annual Meeting, will constitute a quorum at the Annual Meeting. |

| Q: | What vote is required to approve each of the proposals? |

| | |

| A: | Proposal Nos. 1, 2 and 3 require the affirmative “FOR” vote by holders of a majority of the voting power of the Voting Shares issued and outstanding as of the Record Date and entitled to vote thereon, voting as a single class. Proposal Nos. 4, 5 and 7 require the affirmative “FOR” vote of a majority of the votes cast at the Annual Meeting by the holders of the Voting Shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting as a single class. |

| | With respect to Proposal No. 6, directors are elected by a plurality of the votes cast at the Annual Meeting by the holders of Voting Shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting as a single class. A plurality does not require that a specific percentage of votes be received, but rather, results in the election of those directors receiving the most votes cast. In connection with the execution and delivery of the Merger Agreement, certain Fusion Stockholders entered into a support agreement with BCHI, whereby those Fusion stockholders have agreed, among other things, to vote their Voting Shares in favor of the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement. At the time of execution of the Support Agreement, these shares represented, in the aggregate, 9.8% of the votes entitled to be cast at the Annual Meeting. |

| Q: | What if I abstain from voting or do not vote? |

| A: | An abstention, which occurs when a Fusion Stockholder attends the Annual Meeting, either in person or by proxy, but abstains from voting, will not be considered a vote cast for any proposal. Thus, abstentions will not affect the outcome of Proposal Nos. 4, 5, 6 and 7, but will have the same effect as a vote “AGAINST” Proposal Nos. 1, 2 and 3. If you are a Fusion Stockholder and you fail to attend the Annual Meeting, whether in person or by proxy, or fail to vote at the Annual Meeting (and do not abstain), that will not affect the outcome of Proposal Nos. 4, 5, 6 and 7 (assuming a quorum is present), but will have the same effect as a vote “AGAINST” Proposal Nos. 1, 2 and 3. |

| Q: | What if I don’t vote for a proposal on the proxy that I submit? |

| A: | Unless you give other instructions on your proxy card that you submit, or unless you give other instructions when you submit your proxy by Internet or by phone, the persons named as proxies will vote your shares “FOR” each of Proposal Nos. 1, 2, 3, 4, 5 and 7, and “FOR” each of the eight director nominees identified elsewhere in this proxy statement. If any other business properly comes before the Annual Meeting or any adjournments or postponements thereof, the persons named as proxies will vote your Voting Shares in accordance with the recommendations of the Board. |

| Q: | Is the Merger subject to the satisfaction of any conditions? |

| A: | Yes. In addition to the adoption of the Merger Agreement by the Fusion Stockholders, the Merger is subject to the satisfaction of certain other conditions set forth in the Merger Agreement, including the receipt of certain regulatory approvals. For a description of these conditions, please see the section entitled “The Merger Agreement—Conditions to the Merger” beginning on page 76 of this proxy statement. |

| Q: | When is the Merger expected to be completed? |

A: | Fusion expects to complete the Merger after all conditions to the Merger set forth in the Merger Agreement are satisfied or waived, including the receipt of the required stockholder approvals at the Annual Meeting and the receipt of the required regulatory approvals. Fusion currently expects to complete the Merger in the first quarter of 2018. It is possible, however, that factors outside of Fusion’s control could result in the Merger being completed at a later time or not being completed at all. |

| Q: | Do any of Fusion’s directors or executive officers have interests in the Merger that may differ from, or be in addition to, my interests as Fusion Stockholder? |

| A: | Yes. In considering the recommendation of the Board with respect to the proposal to adopt the Merger Agreement and approve the Merger, the issuance of the Merger Shares and the other transactions contemplated by the Merger Agreement, you should be aware that certain Fusion directors and executive officers have interests in the Merger that are different from, or in addition to, your interests. The Board, including each of its independent directors, was aware of and considered these interests, among other matters, in evaluating, negotiating and approving the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of the Merger Shares. See the section entitled “The Merger – Interests of Fusion’s Officers and Directors in the Merger” beginning on page 60 of this proxy statement. |

| Q: | Who will be the directors of Fusion following the completion of the Merger? |

| A: | From and after the Effective Time, the size of the Board will be fixed at nine directors, which will be selected in accordance with the stockholders’ agreement to be entered into at the closing of the Merger by and among the Company, BCHI Holdings and certain of Fusion’s existing stockholders, as follows: (a) four directors, at least one of whom must be an independent director within the meaning of the Nasdaq listing standards, will be nominated by BCHI Holdings; (b) four directors, at least one of whom must be an independent director within the meaning of the Nasdaq listing standards, will be nominated by the Fusion Committee; and (c) one director, who must be an independent director within the meaning of the Nasdaq listing standards, will be nominated by BCHI Holdings subject to the reasonable consent of the Fusion Committee.Matthew D. Rosen, Fusion’s current Chief Executive Officer, will serve as the post-Merger Chairman of the Board, and Holcombe T. Green, Jr., a principal stockholder of BCHI, will serve as the post-Merger Vice Chairman of the Board.At the Effective Time, all other members of the Board will resign. |

| Q: | Who will be the elected officers of Fusion following completion of the Merger? |

| A: | Matthew D. Rosen will be the Chief Executive Officer of the post-Merger Fusion, Gordon Hutchins, Jr. will be President and Russell Markman will be the Chief Operating Officer. The other executive officers of post-Merger Fusion will be determined prior to the closing of the Merger by mutual agreement of Fusion and BCHI Holdings. As of the date of this proxy statement, no other executive officers have been chosen. |

| Q: | Will the Merger be a taxable transaction to me? |

| A: | The Merger will not result in any taxable gain or loss for U.S. federal income tax purposes to Fusion or any Fusion Stockholder in his or her capacity as a Fusion Stockholder. |

| Q: | Have the BCHI shareholders approved the Merger? |

| A: | Yes. On August 26, 2017, the shareholders of BCHI executed and delivered a written consent in lieu of a meeting adopting the Merger Agreement and approving the Merger and the other transactions contemplated thereby. |

| Q: | What happens if the Merger is not completed? |

| A: | If any of the proposals to adopt the Merger Agreement, to adopt Certificate of Amendment or to adopt the Restated Charter is not approved by the Fusion Stockholders at the Annual Meeting, or if the Merger is not consummated for any other reason: ● the Company will not issue the Merger Shares to BCHI Holding; ● BCHI will not become a part of the business of Fusion and Fusion will continue to operate as it did prior to entering into the Merger Agreement; ● the Company will not file the Restated Charter, as contemplated by Proposal No. 3, but will file an amendment to the Company’s existing certificate of incorporation solely to change the name of the Company to “Fusion Connect, Inc.” ● The director nominees elected by the Fusion Stockholders at the Annual Meeting pursuant to Proposal No. 6 will continue to serve as directors of the Company until the Company’s 2018 annual meeting of stockholders and until such time as their respective successors are elected and qualified or until their earlier resignation, death or removal from office. Moreover, if the proposal to adopt the Certificate of Amendment is approved by the Fusion Stockholders at the Annual Meeting, but the Board subsequently determines that the Merger is not likely to be consummated for any reason, the Board may determine to abandon the reverse stock split, in which case the Company will not file the Certificate of Amendment, as contemplated by Proposal No. 2. |

| Q: | Am I entitled to appraisal rights? |

| A: | No. Fusion Stockholders are not entitled to appraisal rights under the Delaware General Corporation Law, as amended (referred to as the DGCL), in connection with the Merger, the issuance of the Merger Shares or any other transactions contemplated by the Merger Agreement, or in connection with any other matters to be submitted to a vote of Fusion Stockholders at the Annual Meeting. |

| Q: | Will holders of the Merger Shares be able to trade those shares? |

| A: | The Merger Shares to be issued to BCHI Holdings as consideration in the Merger will be issued in transactions exempt from registration under the Securities Act of 1933, as amended (referred to as the Securities Act), in reliance on Section 4(a)(2) of the Securities Act or Regulation D promulgated thereunder, and may not be offered or sold by the holders of those shares absent registration or an applicable exemption from registration requirements. As a general matter, holders of the Merger Shares will not be able to transfer any of their shares until at least six months after receiving the Merger Shares, at which time the Merger Shares would first become eligible to be sold under Rule 144 promulgated under the Securities Act, assuming the conditions thereof are otherwise satisfied and subject to the limitations set forth in such rule. However, in connection with the Merger, Fusion has agreed to enter into a registration rights agreement with BCHI Holdings (referred to as the Registration Rights Agreement), pursuant to which, following the completion of the Merger, Fusion will file with the SEC a shelf registration statement to register no more than 25% of the total number of the Merger Shares for resale in the public markets. Upon such shelf registration statement being declared effective by the SEC, such Merger Shares will be freely tradeable. For a more detailed summary of the Registration Rights Agreement and the transactions contemplated thereby, see the section entitled “Agreements Related to the Merger Agreement – Registration Rights Agreement” beginning on page 80 of this proxy statement. |

| Q: | Should I send in my stock certificates? |

| A: | No. Following the completion of the Merger, the certificates representing your shares of Fusion Common Stock will continue to evidence your ownership of such shares. Also, if the reverse stock split is completed, your existing stock certificates will automatically be deemed to represent the post-split number of shares of Fusion Common Stock. With respect to certificates representing shares of the various series of Fusion’s preferred stock, which shares will be converted into shares of Fusion Common Stock prior to the Effective Time or, if not so converted, cancelled immediately prior to the Effective Time, you may be required to exchange those stock certificates for certificates evidencing shares of Fusion Common Stock. In this case, you will receive further information regarding such exchange at the appropriate time. Please do not send your Fusion stock certificates to the Company or its registrar and transfer agent at this time. |

| Q: | What happens if the Annual Meeting is postponed or adjourned? |

| A: | Unless a new Record Date is fixed for such postponement or adjournment, your proxy will still be valid and may be voted at the postponed or adjourned Annual Meeting. You will still be able to change or revoke your proxy at any time until it is voted. |

| Q: | Who will bear the costs of soliciting votes for the Annual Meeting? |

| A: | Fusion is paying the costs associated with the preparation and distribution these proxy materials and soliciting votes for the Annual Meeting. If you choose to vote over the Internet, you are responsible for any Internet access charges you may incur. If you choose to vote by telephone, you are responsible for any telephone charges you may incur. We intend to retain a proxy solicitor in conjunction with the Annual Meeting, but have not yet selected the Company to perform those services. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communications by our directors, officers and certain of our other employees, who will not receive any additional compensation for such solicitation activities. |

Q: | When should I send in my proxy or voting instructions? |

| A: | You should send in your proxy card via mail, or submit your proxy over the Internet or by telephone as soon as possible, so that your Voting Shares will be voted at the Annual Meeting. If your Voting Shares are held in “street name” by an Organization, you should submit your voting instructions to the Organization through which you hold your Voting Shares, as soon as possible, so that your Voting Shares will be voted at the Annual Meeting. |

| Q: | How can I attend the Annual Meeting? |

| A: | You are entitled to attend the Annual Meeting if you were a Fusion Stockholder as of the Record Date or you hold a valid proxy for the Annual Meeting. If you are not a Fusion Stockholder of record but hold shares as a beneficial owner in street name, you must provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction form provided by your Organization, or other similar evidence of ownership. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-serve basis. You must present a valid photo identification, such as a driver’s license or passport, for admittance. If you do not provide a photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags are subject to search prior to your admittance to the Annual Meeting. The Annual Meeting will begin promptly at 3:00 p.m., local time, on [●], 2018. |

| Q: | Where can I find voting results of the Annual Meeting? |

| A: | We will announce preliminary voting results at the Annual Meeting, and we will publish final voting results in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. |

| Q: | What is the deadline for submitting proposals for or nominating individuals for election as directors at the Company’s 2018 annual meeting of stockholders? |

| A: | As of the date of this proxy statement, we had not received notice of any stockholder proposals for the Annual Meeting, and any proposals received after the date hereof will be considered untimely. For a stockholder proposal to be considered for inclusion in the proxy statement for our 2018 annual meeting of stockholders, our Corporate Secretary must receive the written proposal at our executive office no later than the deadline stated below. Such proposals must comply with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (referred to as the Exchange Act) regarding the inclusion of stockholder proposals in company proxy materials. Proposals should be addressed to: Fusion Telecommunications International, Inc. Attention: Corporate Secretary- Stockholder Proposal 420 Lexington Avenue, Suite 1718 New York, New York 10170 Under Rule 14a-8, in order to be timely, a stockholder proposal must be received at our executive office a reasonable period of time before we send out our notice for that meeting. Upon receipt of any proposal, we will determine whether to include such proposal in accordance with applicable regulations. |

| Q: | Who can answer your questions? |

| A: | If you have a question about this proxy statement or the matters described herein, you may address such question to our Corporate Secretary at the above address, or may call him at (212) 201-2407. |

SUMMARY

This summary highlights selected information contained in this proxy statement and may not contain all of the information that is important to you. To better understand the Merger and the other proposals to be considered at the Annual Meeting, you should read this entire proxy statement carefully, including the Merger Agreement attached hereto as Annex A and the other annexes that are referred herein. Additional important information is also contained in the documents incorporated by reference into this proxy statement. You may obtain such documents without charge by following the instructions in the section entitled “Where You Can Find More Information” beginning on page 117 of this proxy statement.

In this proxy statement, unless the context otherwise requires, the terms “Fusion,” the “Company,” “we,” “us” and “our” refer to Fusion Telecommunications International, Inc., a Delaware corporation. The term “BCHI” refers to Birch Communications Holdings, Inc., a Georgia corporation, and the term “Merger Sub” refers to Fusion BCHI Acquisition LLC, a Delaware limited liability company and wholly-owned subsidiary of Fusion. The term “Merger Agreement” refers to the Agreement and Plan of Merger, dated as of August 26, 2017, as amended on September 15, 2017, September 29, 2017 and October 27, 2017 and as it may be further amended from time to time, by and among Fusion, BCHI and Merger Sub. The term “Board” means the Board of Directors of Fusion, as from time to time constituted. The terms “you” and “Fusion Stockholders” refer to holders of shares of Fusion’s common stock, par value $0.01 per share (the “Fusion Common Stock”) and holders of Fusion’s Series B-2 Senior Cumulative Convertible Preferred Stock, par value $0.01 per share (the “Series B-2 Preferred Stock” and, together with the Fusion Common Stock, collectively, the “Voting Shares”).

Parties to the Merger Agreement

Fusion Telecommunications International, Inc.

420 Lexington Avenue

Suite 1718

New York, New York 10170

(212) 201-2400

Fusion, through its subsidiaries, offers a comprehensive suite of cloud communications, cloud connectivity, and managed cloud-based applications solutions to small, medium and large businesses, and domestic and international voice services to communications carriers worldwide. Our advanced, proprietary cloud services platform enables the integration of leading edge solutions in the cloud, increasing customer collaboration and productivity by seamlessly connecting employees, partners, customers and vendors. We currently operate in two business segments; Business Services and Carrier Services. As a result of the acquisition of various cloud services business during the past four years, Fusion has gone through a significant transformation and has expanded its business customer base, increased its distribution network and added a significant number of network facilities and points of presence expanding its geographic reach.

Additional information about Fusion is provided in its public filings with the SEC, which are incorporated by reference herein. For additional information about Fusion and its business, see the section entitled “Where You Can Find More Information” beginning on page 117 of this proxy statement.

Fusion BCHI Acquisition LLC

420 Lexington Avenue

Suite 1718

New York, New York 10170

(212) 201-2400

Merger Sub is a recently formed Delaware limited liability company and wholly-owned subsidiary of Fusion. Merger Sub was formed solely for the purpose of effectuating the Merger. Merger Sub has not conducted any business operations other than those incident to its formation and the transactions contemplated by the Merger Agreement.

Birch Communications Holdings, Inc.

320 Interstate North Parkway SE

Atlanta, Georgia 30339

(866) 424-5100

BCHI, through its subsidiaries, provides IP-based communications, cloud and managed services to businesses in all 50 states, the District of Columbia and Canada. BCHI provides: voice, broadband, Internet access, hosted services, managed services, wireless voice, wireless data and many other communications, cloud and managed services to its existing customer base of over customers.

The Merger Agreement and the Merger

Structure of the Merger (see page 65)65)